virginia estimated tax payments corporate

Use the appropriate mailing address below when mailing your payment. No penalties interest or addition to tax will be charged if payments are made by June 1 2020.

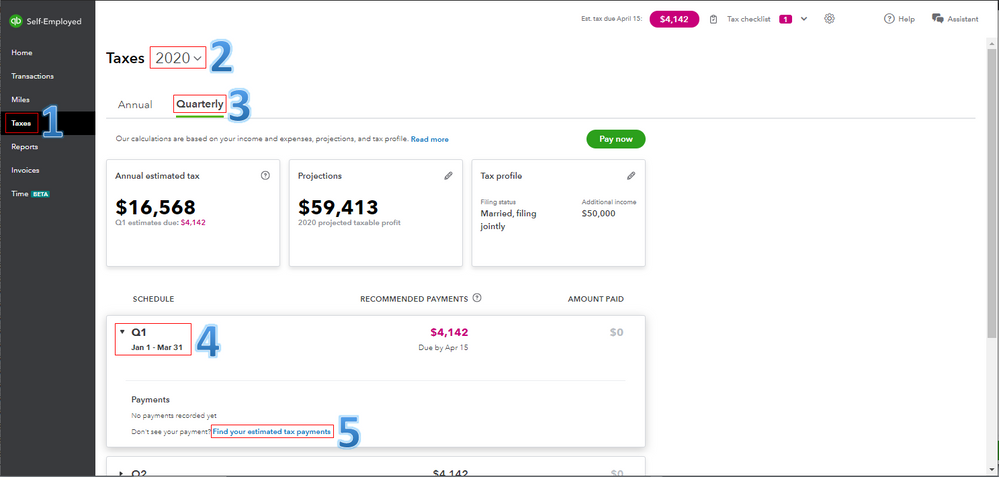

Quarterly Tax Calculator Calculate Estimated Taxes

At present Virginia TAX does not support International ACH Transactions IAT.

. 2 per month or part of a month until Form 502 is filed Maximum penalty is 12 Late payment penalty. CORPORATE NET INCOME TAX If West Virginia taxable income is expected to be at least 10000 when the annual income tax return is filed estimated payments of the Corporate Income Tax liability are required and due in four equal installments on the 15th day of the fourth sixth ninth and twelfth months of the tax year. At present Virginia TAX does not support International ACH Transactions IAT.

Figure the amount of their estimated tax payments. Use Form 502W to make the withholding tax payment by the due date. Code 581504 D.

Please enter your payment details below. How to make an estimated payment. Special Regulatory Revenue Tax Electric Utility Consumption Tax Natural Gas Consumption Tax License Gross Receipts Tax on Water Companies Rolling Stock Tax on Motor Vehicle Carriers Minimum Tax on Telecommunications Companies.

Voucher Number Amount of this Payment. There are four tax brackets for filers in Virginia. The table below shows the tax brackets for Virginia filers.

Virginia Corporate Income Tax Comparison A home business grossing 55000 a year pays 330000 A small business earning 500000 a year pays 300000 A corporation earning 10000000 a year pays 60000000 12 - Virginia Nonprofit Tax Exemptions. If West Virginia taxable income is expected to be at least 10000 when the annual income tax return is filed estimated payments of the Corporate Income Tax liability are required and due in four equal installments on the 15th day of. This means most taxpayers in Virginia will pay the top rate of 575 on at least part of their income.

Please note a 35 fee may be. If you are required to file a tax return and your Virginia income tax liability after subtracting income tax withheld and any allowable credits is expected to be more than 150 then you must make estimated tax payments or have additional income tax withheld throughout the year from your wages or other income. Corporation has an underpayment of estimated tax and believes an addition to the tax should not be assessed Form 500C Underpayment of Virginia Estimated Tax by Corporations must be enclosed with the corporations income tax return along with supporting schedules which document the applicable exception included in.

1546001745 At present Virginia TAX does not support International ACH Transactions IATClick IAT Notice to review the details. Estimated corporation net income tax payments are required for any corporation which can reasonably expect its west virginia taxable income to be in excess of 10000 which equals a tax liability after tax credits in excess of 65000 and are due in four equal installments on the 15th day of the fourth sixth ninth and twelfth months of the. While low earners pay lower marginal rates the top bracket begins at just 17000 in taxable income.

Make tax due estimated tax and extension payments Business Taxes Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes Payment Options Based on the type of payments you want to make you can choose to pay by these options. Directly from your bank account direct debit. Virginia estimated tax payments corporate.

Virginia has an automatic 6-month extension to file your income tax 7 months for certain corporations. Ad Find out what tax credits you qualify for and other tax savings opportunities. Estimated Corporation Net Income Tax payments are required for any Corporation which can reasonably expect its West Virginia taxable income to be in excess of 10000 which equals a tax liability after tax credits in excess of 65000 and are due in four equal installments on the 15th day of the fourth sixth ninth and twelfth months of the tax year.

Voucher Number Amount of this Payment Payment Sign Confirm. First estimated income tax payments for TY 2020. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number.

Penalties for Late Filing and Late Payment Extension penalty Applies if at least 90 of the withholding tax due isnt paid by the original return date for the return. Payment Fee - Returned Payments If your financial institution does not honor your payment to us we may impose a fee of 35 Code of Virginia 22-6141. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number.

Some banks may charge a fee for this service. Please enter your payment details below. Virginia Income Taxes.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. The interest waiver applies to any individual corporate or fiduciary estimated virginia income tax payments that are required to be paid during the period from april 1 2020 to june 1 2020. If west virginia taxable income is expected to be at least.

Please enter your payment details below. Get a personalized recommendation tailored to your state and industry. A corporation may also pay its estimated tax and extension payments by initiating an ACH credit transaction through its bank.

This fee is in addition to any other penalty or. An Electronic Payment Guide is available with information on how. If you file during the extension period make sure you still pay.

The Public Service Taxation Division collects various taxes and fees on the companies it assesses. 770PMT Payment Sign Confirm 770PMT For Period Filing Basis Calendar Fiscal For Taxable Year Fiduciary Form 765 Unified Nonresident Demographics Name of Estate Trust or Unified Filer Name and Title of Fiduciary or Unified Filer Mailing Address City State ZIP 770PMT Do not submit Form 770PMT if no amount is due. Fiduciary and Individual filers who meet these criteria are required to file electronically.

760ES Payment Sign Confirm 760ES For Taxable Year For Taxable Year Demographics Your Social Security Number SSN First Name MI Last Name Spouses SSN If Filing a Joint Return First Name MI Last Name Address City State ZIP Change of Address 760ES Do not submit Form 760ES if no amount is due. Any installment payment of estimated tax exceeds 2500 or Any payment made for an extension of time to file exceeds 2500 or The total income tax liability for the year exceeds 10000. 760ES For Taxable Year For Taxable Year Demographics Your Social Security Number SSN First Name MI Last Name Spouses SSN If Filing a Joint Return First Name MI Last Name Address City State ZIP Change of Address 760ES Do not submit Form 760ES if no amount is due.

Individual and corporate extension payments for TY 2019.

Use Irs Direct Pay To Pay Their Taxes Including Estimated Taxes Direct Pay Allows Taxpayers To Pay Electronical Estimated Tax Payments Tax Payment Accounting

What If You Haven T Paid Quarterly Taxes Mybanktracker

Quarterly Tax Payment Schedule For Your Business Printable Tax Payment Quarterly Taxes Business Printables

Tax Tips For U S Freelancers Why Skipping Quarterly Payments Could Cost You Estimated Tax Payments Tax Deadline Upwork

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Va Buying First Home Home Buying Process Real Estate Investing Rental Property

41599 Epping Green Sq Aldie Va 20105 Aldie Va Aldie Realty

Learn More About Estimated Tax Form 1040 Es H R Block

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

How To Record Paid Estimated Tax Payment

Form 1040 Es Paying Estimated Taxes Jackson Hewitt

When Are Taxes Due In 2022 Forbes Advisor

Seller S Net Sheet Explained How To Project Your Home Sale Proceeds Worksheet Template Printable Worksheets Cost Sheet

Strategies For Minimizing Estimated Tax Payments

Best Car Sales Tax In Roseville Ca In 2022 Cars For Sale Suv For Sale Used Suv For Sale

Making Estimated Tax Payments How To Avoid Penalties For Underpayment Keybank

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic